On Monday, July 10th, CME Group will launch the E-mini Russel 2000© Index futures and options suite.

CME Group Launches E-mini Russell 2000©

On Monday, July 10th, CME Group will launch the E-mini Russell 2000© Index futures and options suite.

CME will have the exclusive rights to list futures and options on the index. However, at the time of the launch, the futures products will be dually listed by CME as well as by ICE for a period of time to facilitate the transition of open interest between exchanges.

Key take-aways:

- These are two separate futures contracts with the same contract specifications but traded on separate exchanges, clearing houses, and are NOT fungible.

- ICE Exchange Contract Specs – https://www.theice.com/products/86

- Symbol remains the Same

- S5 Trader – GAIN: RLM-M

- Rithmic: TF

- CQG/Continuum: TFE

- Symbol remains the Same

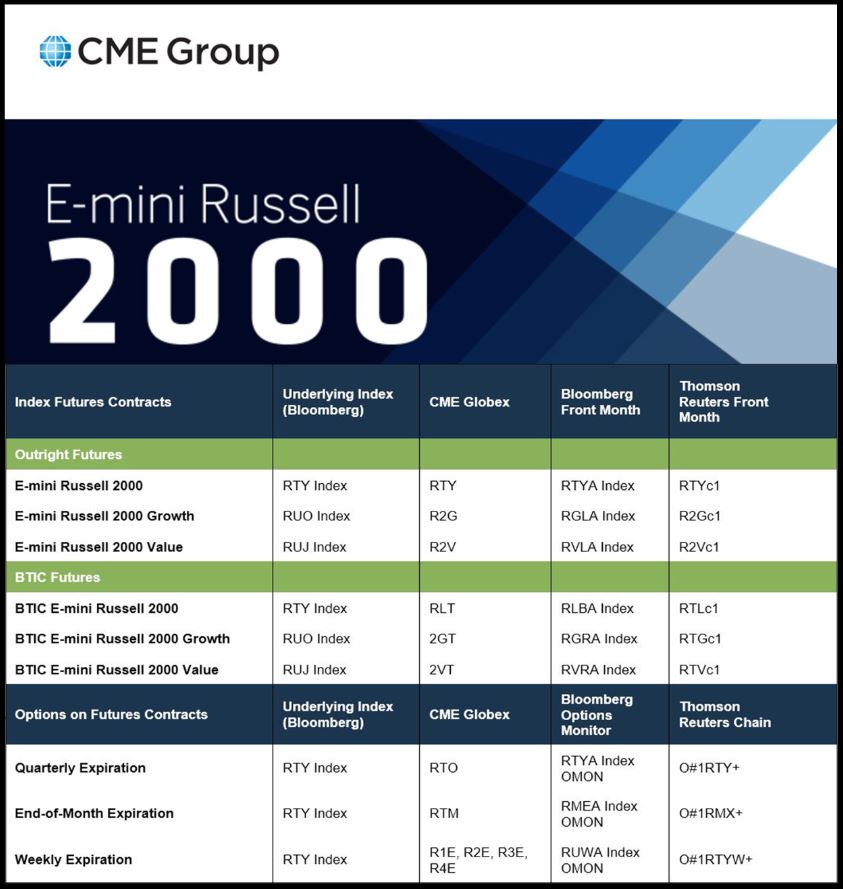

- CME Russell 2000 Contract Specs – https://www.cmegroup.com/trading/equity-index/us-index/e-mini-russell-value-2000_contract_specifications.html

- Symbol

- RTY

- Symbol

- Market Data Exchange Fees remains the same

- ICE Exchange $110 per month

- CME $5 per month

- CME, CBOT, NYMEX, COMEX – $15 per month

- If you already have CME Market data then the RTY real time data will be available without any additional charges.

*NOTICE: Trading Futures and Options on Futures involves substantial risk of loss and is not suitable for all investors. Past performance is not necessarily indicative of future results. Material is provided for informational purposes and was prepared by a third-party believed to be reliable. Stage 5 has not independently verified the content and does not warrant its accuracy.